Is cryptocurrency legal in australia

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. 888 casino app In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

NFTs are multi-use images that are stored on a blockchain. They can be used as art, a way to share QR codes, ticketing and many more things. The first breakout use was for art, with projects like CryptoPunks and Bored Ape Yacht Club gaining large followings. We also list all of the top NFT collections available, including the related NFT coins and tokens.. We collect latest sale and transaction data, plus upcoming NFT collection launches onchain. NFTs are a new and innovative part of the crypto ecosystem that have the potential to change and update many business models for the Web 3 world.

Each of our coin data pages has a graph that shows both the current and historic price information for the coin or token. Normally, the graph starts at the launch of the asset, but it is possible to select specific to and from dates to customize the chart to your own needs. These charts and their information are free to visitors of our website. The most experienced and professional traders often choose to use the best crypto API on the market. Our API enables millions of calls to track current prices and to also investigate historic prices and is used by some of the largest crypto exchanges and financial institutions in the world. CoinMarketCap also provides data about the most successful traders for you to monitor. We also provide data about the latest trending cryptos and trending DEX pairs.

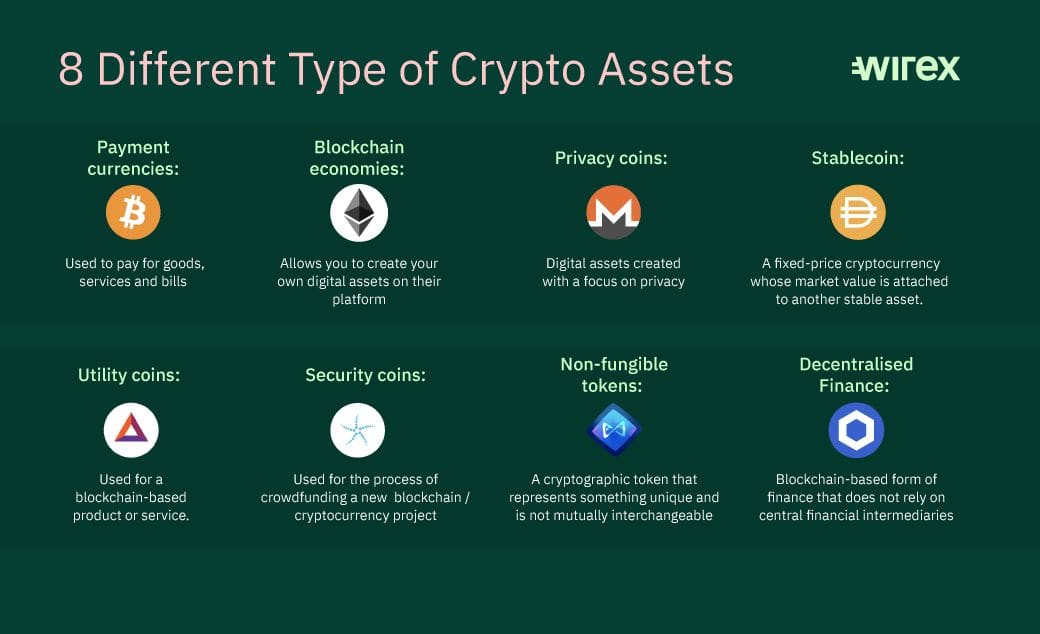

Types of cryptocurrency

This strategy worked great until it didn’t. When panic caused people to cash in their TerraUSD in a mass exodus, TerraUSD de-pegged from its $1 price and slid to near zero, along with Luna. In TerraUSD’s defense, the same panic caused Tether to slip from $1 per coin to $0.94 per coin.

The biggest algorithmic stablecoin on the market today by market cap is DAI. DAI is backed by other cryptocurrencies, including ETH, Wrapped Bitcoin (WBTC) and even other stablecoins like USDC.(3) The crypto assets that back DAI are automatically bought and sold via smart contracts to maintain DAI’s $1 peg.(4)

The above is a more general definition that can be used to refer to all types of cryptocurrencies. As you will learn in this guide, some assets may fall into the fringes of this definition, but they are all cryptocurrencies in one form or the other.

One of the most popular innovations of crypto and blockchain technology is decentralized finance, or DeFi. DeFi offers users a complete range of financial services, from loans to lending to insurance, all governed by automated smart contracts. This means no involvement required from legacy institutional providers, even for high-value transactions where participants don’t know each other. Most DeFi protocols issue their own cryptocurrencies, generally known as DeFi tokens, which provide holders access to these services on their network. Some examples of DeFi tokens include DAI, UNI and LINK.

A portmanteau of “alternative” and “coin”, any cryptocurrency other than Bitcoin (and some say Ether as well) is technically considered an altcoin. Altcoins first came on the scene in 2011 with Namecoin and the far more popular Litecoin, which later became known as “digital silver” to Bitcoin’s gold. Both sought to improve upon certain aspects of Bitcoin, which to that point was still the only crypto in existence. The earliest altcoins were directly based on Bitcoin’s underlying technology, and designed to fulfill a similar purpose as decentralized peer-to-peer payments networks. However each came about to address a perceived shortcoming of the market leader, from slow transaction times to a lack of privacy. Some of the best known altcoins today include Litecoin (LTC) and XRP (XRP)..

Cryptocurrency prices

La volatilité des prix est depuis longtemps l’une des caractéristiques principales du marché des cryptomonnaies. Lorsque les prix des actifs évoluent rapidement, quelque soit la direction, et que le marché est relativement fin, il peut être difficile d’effectuer des transactions dans de bonnes conditions. Afin de surmonter ce problème, un nouveau type de cryptomonnaie ancré à la valeur de devises existantes (du dollar américain à d’autres devises fiat, en passant par d’autres cryptomonnaies) a vu le jour. Ces nouvelles cryptomonnaies sont appelées des stablecoins, et peuvent être utilisées à de multiples fins grâce à leur stabilité. L’un des principaux gagnants est Axie Infinity — un jeu inspiré de Pokémon où les joueurs collectionnent des Axies (des NFT d’animaux de compagnie virtuels), les élèvent et les affrontent contre d’autres joueurs pour gagner du Smooth Love Potion (SLP) — le jeton de récompense du jeu. Ce jeu était extrêmement populaire dans les pays en développement comme les Philippines, en raison du niveau de revenu qu’ils pouvaient gagner. Les joueurs phillipins peuvent vérifier le cours du PHP SLP sur CoinMarketCap.

Ethereum’s own purported goal is to become a global platform for decentralized applications, allowing users from all over the world to write and run software that is resistant to censorship, downtime and fraud.

Among the other co-founders of Ethereum are: – Anthony Di Iorio, who underwrote the project during its early stage of development. – Charles Hoskinson, who played the principal role in establishing the Swiss-based Ethereum Foundation and its legal framework. – Mihai Alisie, who provided assistance in establishing the Ethereum Foundation. – Joseph Lubin, a Canadian entrepreneur, who, like Di Iorio, has helped fund Ethereum during its early days, and later founded an incubator for startups based on ETH called ConsenSys. – Amir Chetrit, who helped co-found Ethereum but stepped away from it early into the development.

With EIP-1559, this process is handled by an automated bidding system, and there is a set “base fee” for transactions to be included in the next block. This fee varies based on how congested the network is. Furthermore, users who wish to speed up their transactions can pay a “priority fee” to a miner for faster inclusion.