Best cryptocurrency

The Shanghai/Capella (“Shapella”) Upgrade is a hard fork that will implement five EIPs — the most anticipated being EIP-4895, which will enable withdrawals. Shanghai is the hard fork’s name on the execution layer, while Capella is the name on the consensus layer.< https://eheilung.com/ /p>

In 2022, Ethereum plans to switch to proof-of-stake with its Ethereum 2.0 update. This switch has been in the Ethereum roadmap since the network’s inception and would see a new consensus mechanism, as well as introduce sharding as a scaling solution. The current Ethereum chain will become the Beacon Chain and serve as a settlement layer for smart contract interactions on other chains.

What exactly are governments and nonprofits doing to reduce Bitcoin energy consumption? Earlier this year in the U.S., a congressional hearing was held on the topic where politicians and tech figures discussed the future of crypto mining in the U.S, specifically highlighting their concerns regarding fossil fuel consumption. Leaders also discussed the current debate surrounding the coal-to-crypto trend, particularly regarding the number of coal plants in New York and Pennsylvania that are in the process of being repurposed into mining farms.

Some examples of prominent cryptocurrencies that have undergone hard forks are the following: Bitcoin’s hard fork that resulted in Bitcoin Cash, Ethereum’s hard fork that resulted in Ethereum Classic.

Xrp cryptocurrency

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

Bitcoin hit a fresh high of $76,849 on Thursday as crypto-friendly candidate Donald Trump won the US presidential election. Institutional demand returned with the highest single-day inflow on Thursday since the ETFs’ launch in January.

Bitcoin founder Satoshi Nakamoto gave a nod of approval to what Rupplepay was doing in the late 2000s, stating: “Ripple is interesting in that it’s the only other system that does something with trust besides concentrate it into a central server.” Fugger sold Rippleypay to Jed McCaleb (co-founder of Stellar and founder of Mt.Gox), Arthur Britto (co-founder and President of PolySign), and David Schwartz (cryptography and computer security expert), who used the original formula and expanded on it with blockchain technology. The new owners renamed the company to OpenCoin.

XRP is a cryptocurrency that was launched in 2012 by Chris Larsen, Jed McCaleb, and Arthur Britto with the intent of creating a decentralized monetary system featuring a real-time gross settlement system, currency exchange, and remittance network. The maximum supply of XRP is 100 billion coins, which were all created at launch, meaning that it is not possible to produce additional XRP tokens. 80% of the total XRP supply was given to fintech firm OpenCoin, a company that was later renamed to Ripple Labs in 2013 and further rebranded to Ripple in 2015. Ripple still holds more than half of the total XRP supply, although a large portion of the company’s XRP holdings is locked in escrow and can only be accessed periodically.

XRP supports large-scale applications and long term projects, with 2.8B+ transactions processed representing over $1T in value moved between counterparties since 2012. XRP also offers lightning-fast, cost-effective transactions that settle every 3-5 seconds at fractions of a cent per transaction.

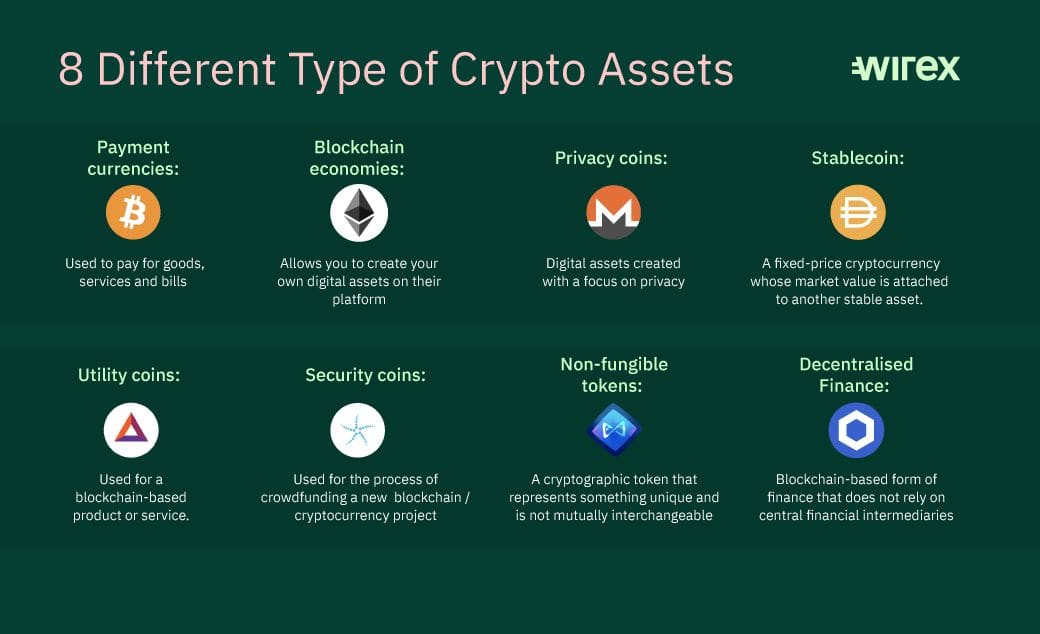

Types of cryptocurrency

The above is a more general definition that can be used to refer to all types of cryptocurrencies. As you will learn in this guide, some assets may fall into the fringes of this definition, but they are all cryptocurrencies in one form or the other.

Because of smart contracts, no third party is needed. Bitcoin means there is no third party needed in direct payments, but smart contracts mean there is no third party needed in lots of things — like the sale of a house, the sale of electricity, or the sale of stock on the stock market.

One type of stablecoin is issued by a financial entity that holds collateral backing for each unit of stablecoin, and the other uses derivative strategies to ensure the crypto asset maintains the value of the underlying government currency.”

It is shared because it is run by lots of different people and companies, instead of just one company, like the banks are. This way, nobody has power over the transactions or the cryptocurrencies involved, and you don’t need to trust one single company (like a bank) to handle your money.

The above is a more general definition that can be used to refer to all types of cryptocurrencies. As you will learn in this guide, some assets may fall into the fringes of this definition, but they are all cryptocurrencies in one form or the other.

Because of smart contracts, no third party is needed. Bitcoin means there is no third party needed in direct payments, but smart contracts mean there is no third party needed in lots of things — like the sale of a house, the sale of electricity, or the sale of stock on the stock market.

Cryptocurrency mining

If you’re using a command line miner to mine a single algorithm, Cudo Miner will be more profitable over a month. This is because our software automatically mines the most profitable coin and automatically changes your overclocking settings for each rather than being fixed to one specific coin. Importantly, Cudo Miner allows you to earn in the coin of your choice, and the platform will automatically trade this for you, so the additional profitability doesn’t come at a compromise to what you want to earn.

Cudo Miner is simple enough for anyone to get started with, yet has features and benefits essential to pro miners. It’s the only miner where you can actually earn the coin of your choice while mining the other more efficient coins, so you always get the most profitable solution.

Absolutely not. Cudo Miner is a software application developed entirely in the UK. All our code is written in-house with DigiCert providing the mark of authenticity, and we use third party code auditors for security compliance.

Automatic algorithm switching ensures you always mine the most profitable coin. Cudo Miner continuously scans the coin value and difficulty, automatically switching your mining efforts to provide the highest profitability at any given time.

If you’re mining on a rig, this feature ensures that you can access controls when required without maxing resources. Also great for ensuring the miner does not get in the way of day-to-day productivity for those mining on a standard PC.