Cryptocurrency list

Tether (USDT) was one of the first and most popular of the stablecoins—alternative cryptocurrencies that aim to peg their market value to a currency or other external reference point to reduce volatility. https://deltawebstest.com/ Because most digital currencies, even major ones like Bitcoin, have experienced frequent periods of dramatic volatility, Tether and other stablecoins attempt to smooth out price fluctuations to attract users who may otherwise be cautious.

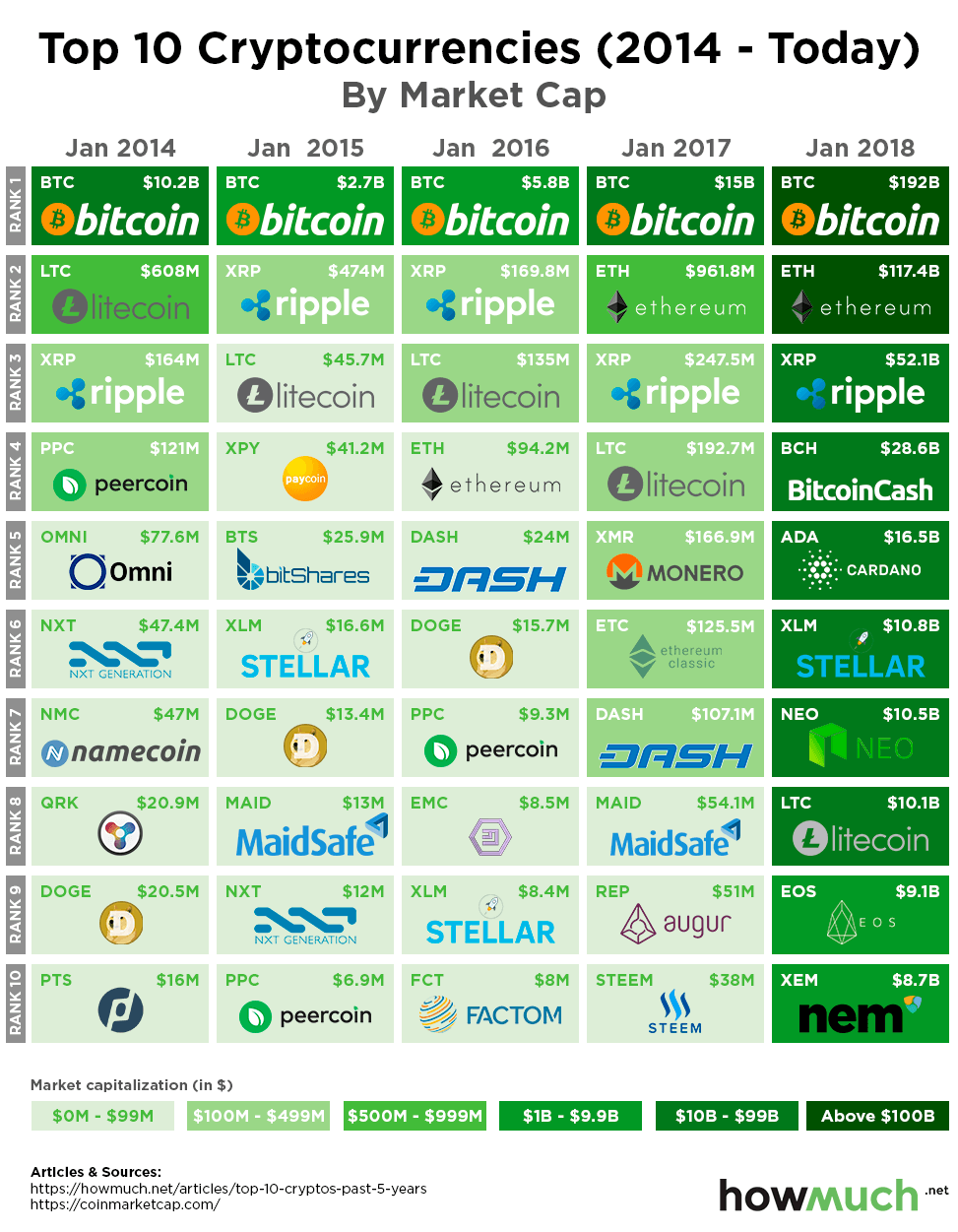

Known for its research-driven approach, Cardano prioritizes sustainability and long-term viability. ADA is trading at $0.81 as of late, demonstrating a whopping 123.4% increase over the past two weeks.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Cryptocurrency meaning

Cryptocurrency is produced by an entire cryptocurrency system collectively, at a rate that is defined when the system is created and that is publicly stated. In centralized banking and economic systems such as the US Federal Reserve System, corporate boards or governments control the supply of currency. In the case of cryptocurrency, companies or governments cannot produce new units and have not so far provided backing for other firms, banks, or corporate entities that hold asset value measured in it. The underlying technical system upon which cryptocurrencies are based was created by Satoshi Nakamoto.

Crypto purchases with credit cards are considered risky, and some exchanges don’t support them. Some credit card companies don’t allow crypto transactions either. This is because cryptocurrencies are highly volatile, and it is not advisable to risk going into debt — or potentially paying high credit card transaction fees — for certain assets.

Jordan Kelley, founder of Robocoin, launched the first bitcoin ATM in the United States on 20 February 2014. The kiosk installed in Austin, Texas, is similar to bank ATMs but has scanners to read government-issued identification such as a driver’s license or a passport to confirm users’ identities.

Cryptocurrency is produced by an entire cryptocurrency system collectively, at a rate that is defined when the system is created and that is publicly stated. In centralized banking and economic systems such as the US Federal Reserve System, corporate boards or governments control the supply of currency. In the case of cryptocurrency, companies or governments cannot produce new units and have not so far provided backing for other firms, banks, or corporate entities that hold asset value measured in it. The underlying technical system upon which cryptocurrencies are based was created by Satoshi Nakamoto.

Crypto purchases with credit cards are considered risky, and some exchanges don’t support them. Some credit card companies don’t allow crypto transactions either. This is because cryptocurrencies are highly volatile, and it is not advisable to risk going into debt — or potentially paying high credit card transaction fees — for certain assets.

Cryptocurrency tax

This also means any profits or income from your cryptocurrency is taxable. However, there is much to unpack regarding how cryptocurrency is taxed because you may or may not owe taxes in given situations. If you own or use cryptocurrency, it’s important to know when you’ll be taxed so you’re not surprised when the IRS comes to collect.

©1997-2024 Intuit, Inc. All rights reserved.Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

All current income is subject to taxation at the point of inflow. Such income is assessed for tax purposes at the time of the inflow on the basis of the value of the acquired cryptocurrency holdings and/or any other remuneration received at that time. This value will also be used in the future to represent the cost of the acquired cryptocurrency holdings for tax purposes.